Main Highlighting points about ADA crypto – Cardano cryptocurrency

- Cardano’s main coin is called “ADA” crypto

- Cardano is a blockchain platform featuring a multi-asset ledger and verifiable smart contracts that intends to be a decentralized application (DApp) development platform.

- Foundation, decentralization, smart contracts, scaling, and governance are the five stages of Cardano development.

- Cardano is a proof-of-stake cryptocurrency which uses Ouroboros consensus protocol and advances.

- The Cardano Foundation, IOHK, and EMURGO are all responsible for Cardano governance.

Cardano is a 3rd generation decentralized proof-of-stake (PoS) blockchain platform that aims to outperform proof-of-work (PoW) networks.

The infrastructure load of rising expenses, energy utilization, and lengthy transaction times limits scalability, interoperability, and sustainability for PoW networks like Ethereum.

The relevance of these issues to blockchain networks were recognized by Charles Hoskinson, co-founder of the proof-of-work (PoW) blockchain Ethereum, who began creating Cardano and its principal cryptocurrency called as ADA crypto in 2015 and launched the platform along with the ADA crypto in 2017.

The Ouroboros consensus protocol is used by the Cardano platform. Its Ouroboros protocol was the first PoS system that was not only proven to be secure, but was also the first to be informed by sophisticated academic study. The research-based framework anchors each development phase, or era, in the Cardano roadmap, incorporating peer-reviewed insights with evidence-based methods to make progress toward and achieve milestones related to the future directions of the blockchain network and the ADA token’s use applications.

Cardano (ADA crypto) history and foundation

The co-founder of Ethereum, Charles Hoskinson started developing Cardano in 2015 and subsequently introduced it in 2017.

Cardano cryptocurrency has placed itself as a crypto that can be used as a replacement for of Ethereum. Both Cardano and Ethereum’s platforms are used for equivalent applications, such as smart contracts, and have the similar objective of creating a decentralized and connected system. Cardano sees itself as a more advanced version of Ethereum, claiming third-generation credentials above Ethereum’s second-generation credentials. The blockchain platform also aims to provide banking services to the unbanked around the world.

The two key applications of Cardano are Identity management and traceability. The Identity management can be used to streamline and simplify operations that involve data collection from numerous sources. And the traceability can be used to trace and audit a product’s manufacturing processes from start to end, potentially eliminating the counterfeit products market.

“ADA” crypto is named after ADA Lovelace, a 19th-century countess and English mathematician who is widely regarded as the first computer programmer.

Cardano’s partners, The Cardano Foundation, IOHK, and EMURGO, share responsibility for the evolution of the Cardano protocol ecosystem, which is decentralized. The Cardano Foundation, a non-profit corporation, is the legal custodian of the Cardano brand and is responsible for its primary governance and control. The foundation raises the protocol’s awareness on a worldwide scale, develops use-case opportunities, and connects policymakers, regulators, and academia.

Cardano was built by IOHK, a software engineering and technology business with a research department focused to boosting blockchain education. IOHK collaborates closely with academic partners to not only enhance its educational goal, but also to improve the Cardano protocol’s long-term scalability by informing platform updates with the most recent peer-reviewed scientific research prior to deployment. EMURGO is the global technology partner in charge of commercializing the Cardano protocol by integrating enterprises from many industries into their blockchain system.

We would recommend you to watch the video by Charles Hoskinson on Cardano

Phases of Cardano Development

Cardano is being developed in five stages to achieve its objective of being a decentralized application development platform with a multi-asset ledger and verified smart contracts. Each of the five phases is referred to as an era and is named after a significant historical figure.

- Byron era – The Foundation

- Shelley era – Decentralization

- Goguen era – Smart Contracts

- Basho era – Scaling

- Voltaire era – Governance

Use Cases for Cardano

The first three products developed by Cardano team are Atala PRISM, Atala SCAN, and Atala Trace. The early product is sited as an identity management solution that may be used for the contribution of service access. It can be used to verify credentials for opening a bank account or qualifying for government assistance, for example. The remaining two products are used to track a product’s progress through a supply chain.

One of the features of Cardano is a smart contract architecture, which would assist in a dependable and protected basis for enterprise level decentralized apps. Cardano’s team wants to employ Project Catalyst, a democratic on-chain governance framework, to manage project development and execution in the near future. They’ll also use Project Catalyst to overhaul its treasury management system in order to cover future charges.

Requirements for Cardano

The algorithm that governs by building blocks and validate transactions is the core of any blockchain network. Cardano uses the algorithm called as Ouroboros. It is an algorithm that employs the proof-of-stake (PoS) protocol. This particular protocol is meant to use as little energy as possible during the block generation process. It accomplishes this by obviating the requirement for hash power, or huge computational resources, which are essential to the operation of Bitcoin’s proof-of-work (PoW) algorithm.

Staking determines a node’s ability to construct blocks in Cardano’s PoS system. The stake of a node is equivalent to the amount of ADA, Cardano’s crypto, it holds over time.

So, how Does the Ouroboros algorithm Work?

In a general word, Ouroboros works by dividing physical time into epochs(periods), which are made up of set intervals of time called slots.

For example, working shifts in a factory are similar to slots. An epoch currently lasts 5 days, and a slot lasts 1 second, however these values are customizable and can be altered when a proposal is submitted. Ouroboros, like the name suggests, epochs work in a circular pattern, with one ending and the next beginning.

A “lottery” mechanism selects a slot leader for each slot. The larger the Stake, the better the chances of winning the lottery in this system. The following are the responsibilities of slot leaders:

- Validating transactions

- Creating transaction blocks

- Adding newly-created blocks to the Cardano blockchain

A limited number of ADA crypto holders must be online and maintain adequate network connectivity for Ouroboros to work. The algorithm incorporates the concept of stake pools to further reduce energy consumption. ADA users can form stake pools and elect a few people to represent them during protocol execution, making it simple to participate and assuring that blocks are created even if some of them are offline.

Considerations in Mining

A stake pool is a dependable server node that is dedicated to running the protocol on behalf of the contributing ADA crypto holders 24 hours a day, 7 days a week. Stake pools are responsible for processing transactions and producing new blocks, and they hold the combined stakes of various stakeholders in a single entity.

The economic incentives for miners to participate in the network and construct blocks in a Proof-of-Work (PoW) system include cryptocurrency rewards and transaction fees. Ouroboros accumulates and distributes rewards from an epoch among stake pools and stakeholders. All gets awarded according to the percentage of their stake that was donated during the period, with a bigger stake receiving more benefits.

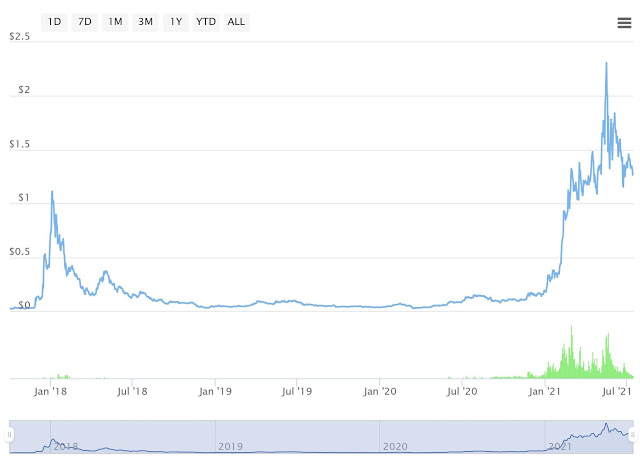

Some stats for ADA crypto

| Current price (during writing this article , 13th July 2021) | $1.27 |

| Circulating Supply | 32.04B ADA (71%) |

| Market Cap | $39,529,495,763.42 |

| Fully Diluted Market Cap | $55,517,101,555.66 |

| Market Rank | #5 |

So, can ADA crypto be a good investment?

Cardano has been labelled as the “Ethereum-killer” for quite some time.

That’s a very bold claim. After all, Ethereum is the second most valuable cryptocurrency project in the world, after only Bitcoin

Bitcoin is the most popular cryptocurrency because it is the first and most recognized of the lot. But Ethereum, due to its appealing integrated applications, has gained market dominance in cryptocurrencies. This is an area where Bitcoin falls short.

Meanwhile, Cardano objectives is to outclass them both by merging the best of Bitcoin and Ethereum. It addresses the underlying issue of Bitcoin’s exorbitant energy consumption, while simultaneously posing a challenge to Ethereum’s alluring smart contracts.

Cardano aims to provide many of Ethereum’s most appealing features, such as scalability and smart contracts. Meanwhile, Hoskinson built Cardano from the ground up to be energy-efficient and facilitate quick transactions with low fees. Cardano also has another significant benefit for hard money investors. In contrast to Ethereum, which has no absolute restriction on its final eventual quantity, it has a rigid limitation of 45 billion coins in circulation.

Cardano has had a lot of success since its inception. By market capitalization, it is now the fifth-largest cryptocurrency. Cardano has a vibrant programming community, and the project has caught a lot of attentions in 2021 as the topic of cryptocurrency’s environmental impact has taken center stage.

Cardano cryptocurrency has a significant advantage in terms of energy efficiency.

Marie Tatibouet, chief marketing officer at renowned cryptocurrency exchange Gate.io said that Cardano’s Ouroboros proof-of-stake algorithm is 20,000 times more efficient than Bitcoin’s mining mechanism. However, Cardano’s main opponent in terms of energy usage is Ethereum. As things are right now, Ethereum isn’t particularly energy-efficient. But it is planning to switch to a proof-of-stake method, similar to Cardano, which would substantially boost its own position.

A proof-of-work protocol is used by Bitcoin and many other traditional cryptocurrencies. Miners solve the complicated mathematical problems using high-powered graphics cards or sophisticated computing setups. Those with better computer power solves more problems and, as a result, receive a larger portion of the mining prize.

What makes proof-of-stake different? Proof-of-stake evades the computing-intensive mining process. Proof-of-stake employs a scarce asset in the form of its cryptocurrency. Stakers commit not to spend their money in exchange for the ability to produce blocks and get block rewards, similar to putting money into a CD or stocks. The chance of getting chosen to develop a certain block is roughly proportionate to the amount of the overall stake held by the user.

Proof-of-stake protocols can use a miner’s tokens as collateral to make the system work, instead of using a lot of processing power and natural resources to keep the blockchain running. Ouroboros, developed by Cardano, was one of the first successful proof-of-stake protocols, providing a viable alternative to proof-of-work tokens.

Issue with Proof-of-stake

So, if this Proof-of-stake algorithm is so efficient, then why aren’t all cryptocurrencies using the proof-of-stake model?

Well, one difficulty is that these systems have a tendency to focus ownership too much. The proof-of-stake time bomb is an issue with proof-of-stake. The user who has the most staked cryptocurrency will be the one who builds the most blocks and receives the most block rewards. If they keep reinvesting their winnings, they will eventually own a larger part of the stake and be able to control the full stake.

This goes against the cryptocurrency community’s distributed authority philosophy. The so-called “nothing at stake” dilemma is another one. Because there is less of a penalty for polluting the blockchain with multiple votes and other false information than there would be in a typical proof-of-work environment like Bitcoin’s, users are more likely to do so. Some critics argue that cryptocurrency doesn’t solve many of the decentralization issues it was designed to tackle without proof-of-work.

- Also read about : What is Bitwise 10 crypto index fund?

- Also read about : OMI crypto

- Also read about : 9 facts about SafeMoon crypto that you must know before investing

However, with personalities like Elon Musk bringing energy usage issues to the front, proof-of-stake has just gotten a lot of attention. Cardano’s Ouroboros appears to be one of the most captivating proof-of-stake choices on the market.

Despite its significant technical advantages, Cardano may yet lose out to Ethereum.

Against Cardano, Ethereum has a significant first-mover advantage. While Cardano’s concentration on academia and non-profits has become its trademark, one could argue that a lack of private sector participation has limited the variety of market-driven use-cases. On ADA, there isn’t any substantial decentralized app under development.

Several experts pointed out that programming for Cardano is more complex than programming for Ethereum. Because of its simplicity, Ethereum has been able to achieve true mass market adoption. Although Cardano offers some technical benefits, Ethereum is the only blockchain that is really enterprise-ready, with backers such as Accenture, JP Morgan Chase, and Microsoft (all members of the Enterprise Ethereum Alliance).

In Conclusion

Cardano is anticipated to have a robust smart contract eco-system that will strive against Ethereum’s DeFi platform. Cardano, on the other hand, is not yet in the same category as Ethereum. Overall, while Cardano’s technical specs are superior to Ethereum’s, it will need to achieve greater real-world utility and adoption before it can surpass Ethereum.

So, is it worth investing in ADA crypto? We don’t know, you decide. All we can say is that there are many aspects of Cardano that are very compelling, groundbreaking and has the potential to be one of the market leaders in the world. So, if you are thinking about investing on ADA, we won’t advise or encourage you to do so because we are not investment advisors, but we will recommend you to keep an eye on and do more market research about the ADA crypto before investing.

Having said that, “Disclaimer” this article is not in any means of evidence or advice for you in investment. Instead, all the things mentioned in this article should be taken as a form of mere general knowledge. All investment involves risk, so always be caution is advised and should consult with the professionals.