In the fast-paced world of cryptocurrency and decentralized finance (DeFi), Synthetix (SNX) stands out as a groundbreaking protocol revolutionizing the way we think about asset trading and investment. If you are new to the world of crypto or a seasoned investor looking to expand your horizons, understanding SNX is crucial for navigating the evolving landscape of DeFi.

A Brief Overview of Synthetix (SNX)

Synthetix is not just another cryptocurrency—it is a decentralized asset insurance protocol built on the Ethereum network. Formerly known as Havven, Synthetix enables users to mint, hold, and trade synthetic decentralized assets, or “Synths.” These Synths are ERC-20 tokens that track the value of real-world assets, including commodities, fiat currencies, stocks, and even cryptocurrencies like Bitcoin (BTC).

Why Understanding SNX Matters in DeFi

In the context of decentralized finance (DeFi), Synthetix plays a pivotal role in democratizing access to traditional financial assets and opening new avenues for trading strategies. As the DeFi ecosystem continues to expand, SNX offers users the opportunity to gain exposure to a diverse range of assets without the need for intermediaries or centralized exchanges.

Understanding SNX is not just about exploring a new investment opportunity—it is about embracing the principles of decentralization and financial inclusivity. By grasping the fundamentals of Synthetix, investors can unlock the potential for innovative trading strategies, participate in governance decisions, and contribute to the growth of the DeFi ecosystem.

In the next sections of this blog post, we will delve deeper into the mechanics of Synthetix, explore its unique features, and discuss how SNX tokens power the entire ecosystem. Whether you are a newcomer to crypto or a seasoned trader, embarking on this journey into the world of SNX is sure to be both enlightening and rewarding.

Stay tuned as we unravel the intricacies of Synthetix and discover why it is poised to shape the future of decentralized finance.

What is Synthetix (SNX)?

Definition and Purpose of Synthetix

At its core, Synthetix is a decentralized asset insurance protocol designed to empower users to mint, hold, and trade synthetic assets, known as Synths. But what exactly does that mean?

Synths are ERC-20 tokens that mirror the value of real-world assets, including commodities, fiat currencies, stocks, and cryptocurrencies. By holding Synths, users gain exposure to these assets’ price movements without needing to directly own them. This opens new opportunities for trading and investment strategies, all within the decentralized ecosystem of Synthetix.

Evolution from Havven to Synthetix

Before becoming Synthetix, the project was known as Havven. Founded by Kain Warwick, Havven aimed to create a stablecoin ecosystem backed by a decentralized collateral pool. Over time, the project evolved to encompass a broader vision of synthetic asset issuance, leading to the rebranding as Synthetix.

The transition from Havven to Synthetix marked a shift in focus towards synthetic asset trading and decentralized finance. Today, Synthetix stands as one of the leading protocols in the DeFi space, offering users unparalleled access to a wide range of synthetic assets.

Key Features and Functionalities of the Synthetix Protocol

Synthetix boasts several key features and functionalities that set it apart in the world of decentralized finance:

- Decentralized Asset Issuance: Through the use of smart contracts on the Ethereum network, Synthetix allows users to issue synthetic assets with ease. This decentralized approach ensures transparency, security, and censorship resistance.

- Collateralization with SNX: The Synthetix Network Token (SNX) serves as collateral for the issuance of Synths. Users must stake SNX tokens to mint Synths, creating a collateralized ecosystem that supports the value and stability of the synthetic assets.

- Diverse Asset Selection: Synthetix offers a wide range of Synths, including cryptocurrencies, fiat currencies, commodities, and stocks. This diverse selection allows users to tailor their investment portfolios to their preferences and trading strategies.

- Peer-to-Contract Trading: Unlike traditional exchanges with order books, Synthetix operates on a peer-to-contract trading model. This means that trades are executed directly against smart contracts, providing increased liquidity and efficiency.

- Decentralized Governance: Synthetix is governed by a decentralized autonomous organization (DAO), giving SNX token holders the power to participate in governance decisions. This ensures that the protocol remains community-driven and adaptable to evolving market conditions.

As we continue our exploration of Synthetix, we will delve deeper into these features and functionalities, uncovering the mechanics behind this innovative decentralized finance protocol. Stay tuned for insights into how Synthetix is shaping the future of asset trading and investment in the DeFi landscape.

How Does Synthetix Work?

Synthetix operates at the intersection of blockchain technology and decentralized finance (DeFi), offering users a unique platform for trading synthetic assets. But how exactly does Synthetix work? Let us break it down.

Explanation of Synthetic Assets and Synths

At the heart of Synthetix lies the concept of synthetic assets, represented by ERC-20 tokens known as Synths. These synthetic assets mimic the value of real-world assets, such as commodities, fiat currencies, stocks, and cryptocurrencies. However, unlike traditional assets, Synths are issued and traded on the Ethereum blockchain, providing users with decentralized access to a diverse range of investment opportunities.

Synths enable users to gain exposure to asset classes that may otherwise be inaccessible or difficult to trade within the confines of traditional finance. Whether it is gold, Bitcoin, or even the S&P 500 index, Synths offer a gateway to global markets, all from the comfort of a decentralized ecosystem.

Role of SNX Tokens in Collateralizing Synths

Central to the functioning of Synthetix is the Synthetix Network Token (SNX), which serves as collateral for the issuance of Synths. When users wish to mint Synths, they must stake a certain amount of SNX tokens as collateral. This collateralization model ensures that Synths maintain their value and stability, backed by the underlying assets represented by the Synths.

The collateralization ratio, currently set at 750%, determines the amount of SNX required to mint a specific value of Synths. By maintaining this ratio, users contribute to the overall security and liquidity of the Synthetix ecosystem, playing a vital role in its decentralized operation.

Governance Structure: Protocol DAO, Grants DAO, and Synthetix DAO

Synthetix operates under a decentralized governance structure, facilitated by three autonomous organizations:

- Protocol DAO: Responsible for funding protocol upgrades and changes to Synthetix’s smart contracts, Protocol DAO ensures the continuous improvement and development of the Synthetix protocol.

- Grants DAO: This organization allocates funding for community proposals aimed at enhancing the Synthetix ecosystem. From initiatives promoting education and awareness to projects focusing on user experience and development, Grants DAO supports a diverse range of endeavors within the community.

- Synthetix DAO: Tasked with funding entities advancing the network’s development, Synthetix DAO plays a pivotal role in driving innovation and growth within the Synthetix ecosystem. By supporting projects and initiatives aligned with the protocol’s vision, Synthetix DAO contributes to the long-term sustainability and success of Synthetix.

Together, these DAOs empower the Synthetix community to participate in governance decisions, ensuring a decentralized and inclusive approach to protocol management. By harnessing the collective wisdom and expertise of its stakeholders, Synthetix remains agile and adaptive in navigating the evolving landscape of decentralized finance.

As we unravel the intricacies of Synthetix, we gain a deeper appreciation for its innovative approach to synthetic asset trading and decentralized governance. In the next section, we will explore the practical applications of Synthetix and its impact on the broader DeFi ecosystem. Stay tuned for insights into how Synthetix is reshaping the future of finance, one synthetic asset at a time.

Also read about: All you need to know about PulseChain Crypto

Founders and Team Behind Synthetix

As with any groundbreaking project, Synthetix owes its success to the vision and dedication of its founders and core team members. Let us take a closer look at the individuals driving innovation within the Synthetix ecosystem.

Overview of Kain Warwick and Other Core Team Members

At the helm of Synthetix is Kain Warwick, the founder of the project and a driving force behind its development. Warwick brings a wealth of experience in cryptocurrency payment platforms, having previously founded Blueshyft, one of Australia’s largest platforms in this space. As a non-executive director at Blueshyft and an Advisory Council Member at Blockchain Australia, Warwick’s expertise in blockchain technology and finance positions him as a leading figure in the crypto industry.

Alongside Warwick, the Synthetix team comprises individuals with diverse backgrounds and expertise, each contributing their unique skills to the project’s success. Among these key team members are:

- Justin Moses (CTO): With a background in engineering and extensive experience in large-scale systems, Moses oversees the technical aspects of Synthetix, ensuring the platform’s reliability and scalability.

- Clint Ennis (Senior Architect): Drawing from over 18 years of experience in software engineering, Ennis brings his expertise from traditional finance to Synthetix, guiding the architectural design and development of the platform.

Background and Expertise of the Founders

Warwick’s journey in the cryptocurrency space began with the founding of Blueshyft, where he gained firsthand experience in developing payment solutions and navigating regulatory frameworks. This experience laid the foundation for his venture into decentralized finance, culminating in the creation of Synthetix.

Milestones and Achievements of the Project

Since its inception, Synthetix has achieved significant milestones, solidifying its position as a leader in the DeFi landscape. Some notable achievements include:

- Rebranding from Havven to Synthetix: The project underwent a strategic rebranding in recognition of its expanded scope and vision, signaling its evolution into a comprehensive platform for synthetic assets.

- Successful ICO and Token Sale: Synthetix raised $30 million USD through its Initial Coin Offering (ICO) and token sale, attracting investment from major crypto funds, and securing the resources needed for further development.

- Decentralized Governance: Synthetix transitioned to a decentralized governance model, empowering the community to participate in decision-making processes through the Protocol DAO, Grants DAO, and Synthetix DAO.

These milestones underscore Synthetix’s commitment to innovation and its relentless pursuit of excellence in decentralized finance. As we delve deeper into the project’s impact and potential, it becomes evident that Synthetix is poised to shape the future of finance in profound ways.

Unique Features of Synthetix Network

Synthetix Network stands out in the decentralized finance (DeFi) landscape due to its array of unique features and innovative solutions. Let us explore some of the key aspects that set Synthetix apart from other projects in the crypto space.

A. Peer-to-Contract Trading and Infinite Liquidity

One of the standout features of Synthetix is its peer-to-contract (P2C) trading mechanism, which enables users to exchange Synths without the need for a traditional order book. In this model, trades are executed directly against smart contracts, providing seamless transactions and unlimited liquidity.

Unlike centralized exchanges that rely on order matching between buyers and sellers, Synthetix’s P2C trading ensures rapid execution and efficient price discovery. This innovative approach democratizes access to liquidity and minimizes the risk of slippage, enhancing the overall trading experience for users.

B. Synths Trading on Kwenta Decentralized Exchange (DEX)

Kwenta, Synthetix’s decentralized exchange (DEX), serves as the primary platform for trading synthetic assets known as Synths. Users can access Kwenta to buy, sell, and trade a diverse range of Synths, including fiat currencies, cryptocurrencies, commodities, and more.

What sets Kwenta apart is its intuitive interface and seamless user experience, making it accessible to both novice and experienced traders. By leveraging the power of blockchain technology, Kwenta provides secure and transparent trading while eliminating the need for intermediaries.

C. Synths Ecosystem: Fiat Synths, Inverse Synths, and More

The Synthetix ecosystem offers a wide variety of Synths, each designed to cater to different trading strategies and preferences. Among the most notable Synths are:

- Fiat Synths: These Synths mirror the value of fiat currencies such as the US dollar (sUSD), Euro (sEUR), and Australian dollar (sAUD), providing users with exposure to traditional financial assets within the crypto space.

- Inverse Synths: In addition to traditional Synths, Synthetix also offers inverse Synths that allow users to profit from downward price movements. For example, inverse Bitcoin (iBTC) Synths enable traders to capitalize on the decline in Bitcoin’s price without holding the underlying asset.

- Commodity Synths: Synthetix extends its reach beyond traditional currencies and cryptocurrencies by offering Synths tied to real-world commodities such as gold (sXAU) and silver (sXAG). These Synths enable users to diversify their investment portfolio and hedge against market volatility.

By providing access to a diverse range of Synths, Synthetix empowers users to explore new trading opportunities and create customized investment strategies tailored to their unique needs.

In summary, Synthetix Network stands out for its innovative approach to decentralized finance, offering a seamless trading experience, a diverse range of synthetic assets, and unparalleled liquidity. As the DeFi ecosystem continues to evolve, Synthetix remains at the forefront, driving innovation and pushing the boundaries of what is possible in the world of finance.

Also read about: For The First Time New ZetaChain Got Exposed

Value Proposition of SNX Tokens

Synthetix Network Token (SNX) plays a crucial role within the Synthetix ecosystem, offering a range of benefits and value propositions to its holders. Let us delve into the key aspects that contribute to the significance of SNX tokens.

A. Collateralization Ratio and Staking Rewards

At the core of the Synthetix protocol lies the concept of collateralization, wherein SNX tokens are used to collateralize synthetic assets, or Synths. Each Synth is backed by a certain amount of SNX tokens, ensuring the stability and security of the platform.

One of the primary functions of SNX tokens is to maintain the collateralization ratio, which currently stands at 750%. This ratio determines the amount of SNX required to mint a certain value of Synths. By staking their SNX tokens, users contribute to the collateral pool and help maintain the stability of the Synthetix ecosystem.

In addition to securing the network, SNX stakers are rewarded for their participation through various mechanisms. Stakers receive staking rewards in the form of additional SNX tokens, incentivizing them to actively participate in the governance and operation of the platform.

B. Importance of SNX in the Synthetix Ecosystem

SNX tokens serve as the backbone of the Synthetix ecosystem, underpinning its decentralized and permissionless nature. As the native utility token of the platform, SNX facilitates the creation, trading, and management of synthetic assets, enabling users to access a wide range of financial instruments within the DeFi space.

Furthermore, SNX holders play a crucial role in governing the protocol through decentralized autonomous organizations (DAOs). By participating in governance decisions, SNX holders have a direct impact on the direction and evolution of the Synthetix network, ensuring its continued growth and sustainability.

C. Factors Influencing the Value of SNX Tokens

The value of SNX tokens is influenced by a variety of factors, including:

- Demand for Synths: As the demand for synthetic assets grows within the DeFi ecosystem, the value of SNX tokens may increase accordingly. Higher demand for Synths implies greater utilization of the Synthetix platform, driving demand for SNX tokens to collateralize these assets.

- Staking Participation: The level of staking participation among SNX holders can also impact the token’s value. Higher staking participation strengthens the security and stability of the network, increasing confidence in the platform and potentially attracting more users and investors.

- Market Sentiment: Like all cryptocurrencies, SNX tokens are subject to market sentiment and investor speculation. Positive developments, partnerships, and community engagement initiatives can bolster investor confidence and drive demand for SNX tokens, leading to price appreciation.

- Overall DeFi Market Trends: SNX token value may also be influenced by broader trends in the decentralized finance market. Factors such as the adoption of DeFi protocols, regulatory developments, and macroeconomic conditions can impact investor sentiment and the perceived value of SNX tokens.

In conclusion, SNX tokens offer a compelling value proposition within the Synthetix ecosystem, serving as the cornerstone of decentralized asset collateralization and governance. As the DeFi space continues to evolve, SNX holders stand to benefit from the growth and expansion of the Synthetix network, driving value for all participants.

How to Use Synthetix Network Token

Synthetix Network Token (SNX) opens a world of opportunities within the Synthetix ecosystem, allowing users to trade synthetic assets, stake tokens for rewards, and securely store their assets. Here is a step-by-step guide on how to make the most of SNX tokens:

A. Steps to Trading Synths on Kwenta

- Acquire SNX Tokens: Before you can start trading Synths, you will need to acquire SNX tokens. You can purchase them from various cryptocurrency exchanges.

- Access Kwenta: Kwenta is a decentralized exchange (DEX) built on the Synthetix protocol. Access the Kwenta platform through your preferred web browser.

- Connect Your Wallet: To begin trading, you will need to connect your Ethereum-compatible wallet to Kwenta. Supported wallets include Metamask, WalletConnect, and others.

- Select Synths: Once connected, browse the list of available Synths on Kwenta. Choose the Synths you wish to trade based on your investment strategy and market analysis.

- Execute Trades: After selecting your desired Synths, you can execute trades directly on the Kwenta platform. Simply specify the number of Synths you want to buy or sell and confirm the transaction using your wallet.

B. Staking SNX Tokens for Rewards

- Navigate to Mintr: Mintr is a decentralized application (dApp) created by Synthetix for staking SNX tokens and participating in the network’s governance.

- Connect Your Wallet: Access the Mintr dApp and connect your Ethereum-compatible wallet to the platform.

- Stake SNX Tokens: Once connected, navigate to the staking section of the Mintr dApp and stake your SNX tokens. By staking SNX, you contribute to the collateralization of Synths and earn rewards in return.

- Monitor Rewards: Keep track of your staking rewards, which are denominated in SNX tokens. Rewards are distributed based on your contribution to the network and the prevailing staking rewards rate.

C. Choosing the Right Wallet for Storing SNX Tokens

- Hardware Wallets: For maximum security, consider storing your SNX tokens in a hardware wallet such as Ledger or Trezor. Hardware wallets offer offline storage and robust security features, making them ideal for long-term storage.

- Software Wallets: Software wallets like Metamask and Trust Wallet provide a convenient option for storing and accessing SNX tokens. These wallets are compatible with various devices and offer a balance of security and usability.

- Online Exchanges: While less secure than hardware and software wallets, online exchanges like Binance and Coinbase allow you to store SNX tokens in exchange wallets. Exercise caution when storing substantial amounts of SNX on exchanges due to potential security risks.

Regardless of the wallet you choose, ensure that it supports ERC-20 tokens and offers strong security features to safeguard your SNX tokens against unauthorized access. By following these steps, you can effectively utilize SNX tokens and participate in the vibrant ecosystem of synthetic assets powered by Synthetix.

Current State and Future Outlook

As we delve into the current state and outlook of Synthetix Network Token (SNX), it is essential to analyze market data, recent developments, and potential future use cases. Let us explore what lies ahead for SNX:

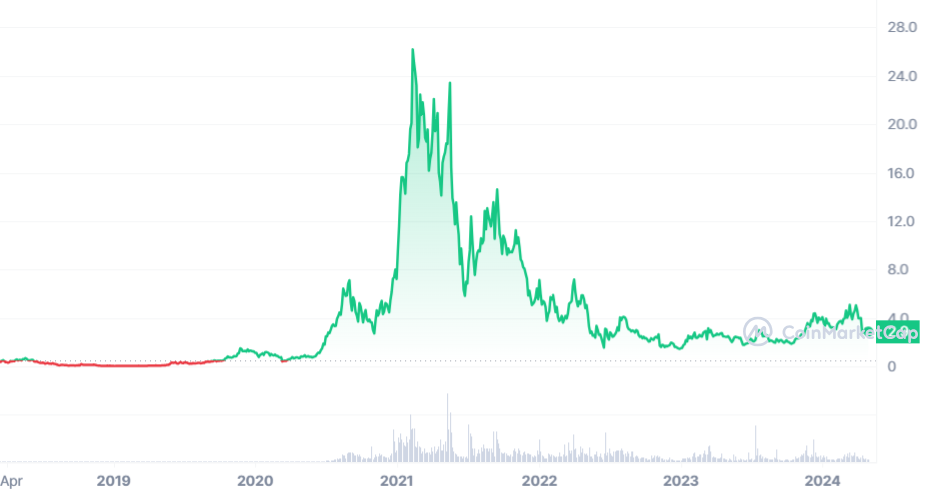

A. Market Data: SNX Price, Market Capitalization, and Trading Volume

- SNX Price: The price of SNX fluctuates based on market demand and investor sentiment. Keep an eye on cryptocurrency exchanges to track the latest price movements of SNX tokens.

- Market Capitalization: Market capitalization reflects the total value of all SNX tokens in circulation. Monitor SNX’s market capitalization to gauge its relative position within the cryptocurrency market.

- Trading Volume: Trading volume indicates the level of activity and liquidity in SNX markets. Higher trading volumes often signify increased investor interest and participation.

B. Recent Developments and Partnerships

- Partnerships: Synthetix continues to forge strategic partnerships with leading organizations in the cryptocurrency and decentralized finance (DeFi) space. Stay updated on recent partnerships to understand Synthetix’s expanding ecosystem.

- Product Launches: Keep an eye out for new product launches and updates from the Synthetix team. These developments may introduce innovative features and functionalities to the Synthetix protocol.

C. Potential Future Developments and Use Cases

- Expansion of Synthetic Assets: Synthetix aims to expand its range of synthetic assets to include a broader array of traditional and digital assets. Look out for new Synths representing commodities, stocks, and other asset classes.

- Enhanced Governance Mechanisms: As decentralized autonomous organizations (DAOs) gain prominence, Synthetix may introduce enhanced governance mechanisms to empower token holders and community members.

- Integration with DeFi Ecosystem: Synthetix is likely to deepen its integration with other decentralized finance (DeFi) protocols, allowing users to seamlessly interact with a diverse range of DeFi applications.

- Mainnet Upgrades: Anticipate mainnet upgrades and protocol improvements designed to enhance scalability, security, and overall performance of the Synthetix network.

In summary, the outlook for Synthetix Network Token (SNX) is characterized by ongoing market growth, innovative developments, and expanded use cases within the decentralized finance (DeFi) ecosystem. Stay informed about market trends and project updates to capitalize on the evolving opportunities presented by SNX.

Conclusion

As we conclude our exploration of Synthetix Network Token (SNX), throughout this blog, we have delved into the intricacies of Synthetix, understanding its role as a decentralized asset insurance protocol and its evolution from Havven to Synthetix. We have explored the concept of synthetic assets and Synths, the governance structure behind Synthetix, and the unique features of the protocol. Additionally, we have examined the value proposition of SNX tokens, how to use them within the Synthetix ecosystem, and the current state and outlook of SNX.

Moreover, Synthetix contributes to the maturity and growth of the DeFi ecosystem by facilitating price discovery, hedging against volatility, and expanding access to traditional and digital assets. Its peer-to-contract trading mechanism, infinite liquidity, and integration with other DeFi protocols make it a cornerstone of the evolving DeFi landscape.

In conclusion, Synthetix represents a change in basic assumptions in financial markets, offering decentralized access to a diverse range of assets and empowering individuals to participate in the global economy like never before. Embrace the opportunities presented by Synthetix, and embark on your journey towards financial freedom in the decentralized future.

Disclaimer:

The information provided in this post is for educational purposes only and should not be construed as investment advice. Cryptocurrency investments carry inherent risks and are subject to market volatility. It is important to conduct your own research and due diligence before making any investment decisions. The content of this post does not constitute financial or investment advice, and the author and publisher shall not be held liable for any losses or damages resulting from reliance on the information provided herein. Always consult with a qualified financial advisor or investment professional before investing in cryptocurrencies or any other financial instruments.